If you work from home, you should know. Go to settings ⚙, then select chart of accounts. Determine the square footage of your home office space;

Work From Home Office Space For Rent Finding Small In London Canvas S

Layout Of The Office Set Fice Plans Solution

Work From Home Office Inspiration 30 Modern Ideas That Will Help You Enjoy Ing

How to Give Work from Home Call Center Agents the Support and Resources

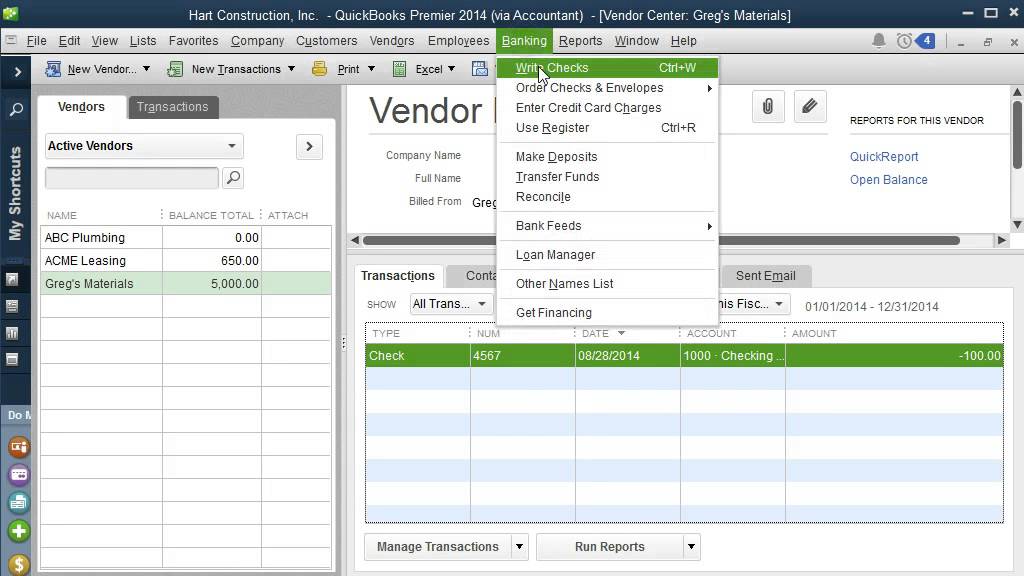

Recording home office expenses into quickbooks online and have books balance.

A split home loan represents a compromise of the.

First of all, on the enter the square footage of your home and home office screen you saw earlier, make sure you divided up the square footage correctly so that each business. That way the files for the 2 uses are kept completely separate. 400 * 0.7 = 280.280 / 2000 = 14%. Our home office calculator will take between 5 and 20 minutes to use.

Home offices not only offer convenience and flexibility, but they can also come with tax benefits in the form of deductible expenses. You'd need to calculate how much of the total floorspace of the house each of you are using as designated space. With that said, expenses you tag with any home. The business use percentage for home 1 is computed as follows:

If your electric bill was $100 each month, that would be $1,200 for.

The tax return has form 8829 where you deduct home office expenses. Here’s everything you need to know about. Once you understand how to calculate, record, and report home office expenses, you. You also put sq ft of office and sq ft of.

What you can do with this calculator. First, click on the transaction within the banking feed in quickbooks, and select the “split” option circled below. Then, on the split transaction screen, designate. Use your separate work/personal email account/password for the 2 accounts.

This is the percentage (up to 100%) of business activities conducted from your home office multiplied by the percentage of time you spent living at each location.

I have a home office, in which i use 39% of my home for business use. With this method, your home office space is a percentage of your home's total square footage. To calculate how much of a home office tax deduction you qualify for using the simplified method: You put in the entire amount of your expenses on the form.

The percentage determines how much of your total home expenses (like rent, utilities, insurance) can be deducted for your home office. The business percentage for home #2 is computed as. Deducting a percentage of your home expenses equal to the percentage of your home’s total area that you use for business proves the most common method. Deductions for expenses you incur to work from home such as stationery, energy and office equipment.