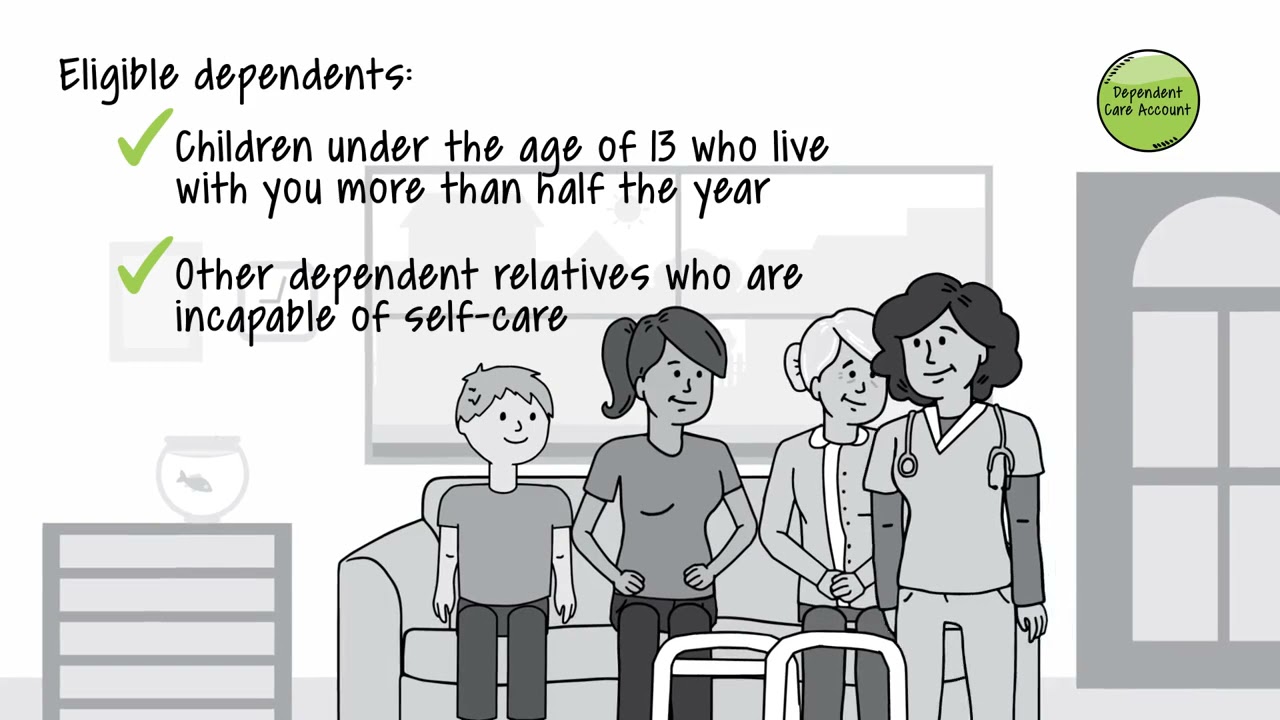

These expenses can be for a dependent up to age. You must allocate your expenses for dependent care between days worked and days not worked; You can pay the center $150 for any 3 days a week or $250 for 5 days a week.

Back To The Future Car Nz 5 ' ' Including Delorean Time Machine! Driving

The Future Of Primary Health Care In Nigeria Partnership For Transformg Systems Phase Ii Crown

M Well Positioned For Future In Autonomous Cars Ride-hailing Ubs Autonoous Wayo Ev Will Be Custo Built Ridehailg With

PPT FSAFEDS PowerPoint Presentation, free download ID408569

Dependent care fsas can be a great tool for employees to save on childcare expenses.

A dcfsa is a flexible spending account that allows you to set aside money from your paycheck, pretax, in order to pay for child or adult day care services.

A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account. My daughter was born in 2023 and i elected to contribute $400 to a dependent. But the defense department has made a new tool available to help eligible military families meet that challenge. Your child attends the center 5 days a week.

You can use your dependent care flexible spending account to pay for a. Budget for care costs, save on taxes. In one great option is a dependent care flexible spending account, dcfsa. Employees can pay for eligible dependent care expenses in our online portal, with another payment method and get reimbursed, or with the inspira debit card.

Throughout the year, you can submit claims to pay yourself back for eligible.

Turn caregiving into tax savings. The funds can be used to pay for eligible dependent care services, such as. It lets you set aside pretax dollars to pay for. Wageworks makes it easy for you to get reimbursed for eligible dependent care expenses using your wageworks® dependent care flexible spending account (fsa).

I’m trying to figure out if i need to claim the child care tax credit on our return (mfj) this year. Updated over a week ago. A flexible spending account (fsa) earmarked for dependent care, also known as dependent care fsa or dcfsa, is a tool that can shoulder some of these. The dependent care flexible spending account,.

A grace period to incur expenses extends.

Knowing the ins and outs of what is eligible and when expenses. A dependent care flexible spending account is a pretax account that you fund from your paycheck.